How to calculate the TCO (Total cost of ownership)?

It's essential to understand the factors for which TCO calculation should be a top priority for a business before learning how to calculate the TCO (Total Cost of Ownership).

The major reason behind TCO calculation is to measure the upfront cost of long term or indirect expenses of an organization especially in case of implementing the new technologies. Without calculating the TCO there is a high chance of having miscalculations in the organization.

Let's talk from the ERP perspective, if your organization wants to purchase a software then calculating the TCO (Total Cost of Ownership) is nothing but calculating the softwares purchase and upcoming cost as maintenance cost, support cost, license cost etc. Here a basic question can arise as why organizations should calculate the upcoming cost also. The answer is whenever an organization is going to purchase a software, the upcoming cost is equally important to the organization for the budgeting purpose. Without fixing the budget it's quite tough to make a decision on purchasing new technology or software. So the initial purchase price and associate price both are the vital element of calculating the TCO.

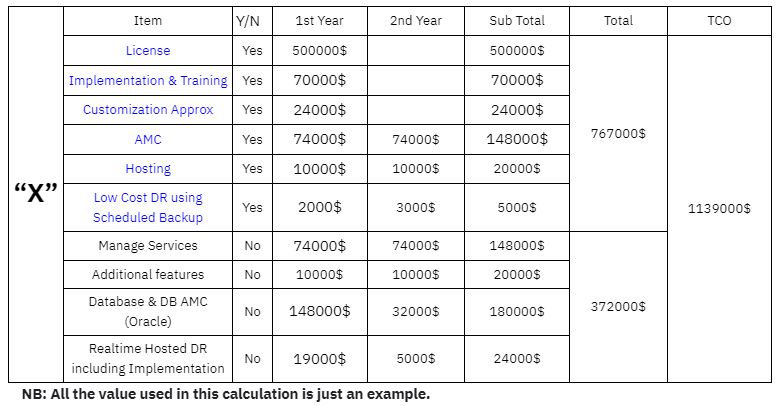

Let's say an organization wants to purchase a software named “X”. The process of calculating the TCO of that organization based on that software “X” is given below:

In this table, we show a 02 year cost calculation for the software “X”. Here, license cost, implementation and training cost, customization approx, AMC, hosting, scheduled backup those are the mandatory costs for software “X” . On the other hand, managing service, additional features, database, real time DR, these are the additional costs.

Based on the table, license, implementation & training, customization approx are the fixed costs which have to be spent on the software purchasing time. Rest of the costs are ongoing costs which will continue for the next year also. After adding this fixed and additional cost, the organization will be able to figure out the TCO(Total Cost of Ownership) of software “X” which is 1139000$ on the table.

Now the organization can decide whether they are going to purchase the software within the budget or not based on the TCO of software “X.

If an organization calculates the TCO first on what they are going to purchase, then they can figure out the difference between their short term and long term expenses both. In addition to that, organizations have a clear idea about their budgeting on purchasing new technology. The utmost beneficial area is current and ongoing both expenses are well defined here.